SQUARE ASSET MANAGEMENT is specialised in three distinct areas of real estate asset management, with the Income Funds having 1.748 million euros in assets under management (December 31th, 2025). This risk/return management is focused on core assets of sectors such as offices, shopping centres, logistics, retail, distribution, among others.

PROPERTY CORE REAL ESTATE FUND

WINNER MSCI

December 31th, 2025

The Fund targets investors that are looking for an investment in real estate market supported by professional and awarded asset management.

The Fund is suitable for investors whose objective is the stability of the NAV, low volatility,

and a potential gain higher than traditional banking applications.

The strong historical performance, combined with low volatility, has been recognized both nationally and internationally.

In 2025, based on 2024 performance, the Fund was awarded the ‘Best Balanced Real Estate Portfolio in Portugal’ by MSCI.

UNIT VALUE 2026-02-09

12,9792 €

- Fund Type Open-Ended Real Estate Investment Fund

- Inception Date 28-08-2020

| Fund Name | PROPERTY CORE REAL ESTATE FUND - Fundo de Investimento Imobiliário Aberto |

| Minimum Recommended

Investment Period |

3 years |

| Currency | Euro (€) |

| ISIN | PTSQUGHM0007 |

| Manager | Square Asset Management, Sociedade Gestora de Organismos de Investimento Coletivo, S.A. |

| Distributor | Best – Banco Eletrónico de Serviço Total, S.A., Novo Banco dos Açores, S.A. and Novo Banco, S.A. |

| Custodian | Novo Banco, S.A. |

| Minimum Subscription Amount | 100€ |

| Following Subscriptions | No Minimum |

| Subscription Fee | 0% |

| Redemption Fee Ups A Units |

Less than 364 days (inclusive): 2%; 365 to 1094 days (inclusive): 1% More than 1095 days: 0% For more information see prospectus |

| Management Fee | 1% per year |

| Custodian Fee | 0,09% per year |

| Performance Fee | 10% of the difference between 12-month Euribor rate plus 2% and the fund performance. |

This information should be supplemented by reading the Fund’s Prospectus and Key Investor Information Document (KIID) which are available on this website, on the CMVM website (www.cmvm.pt), at the placement entities:

CA Património Crescente - (Caixa Central – Caixa Central de Crédito Agrícola Mútuo through their respective branches and internet banking service, and Caixas de Crédito Agrícola Mútuo (as agents of the Caixa Central)) and Depository Bank (Caixa Central — Caixa Central de Crédito Agrícola Mútuo, C.R.L).

Property Core Real Estate Fund - (Best – Banco Eletrónico de Serviço Total, S.A., Novo Banco dos Açores, S.A. and Novo Banco, S.A.) and Depository Bank (Novo Banco S.A.).

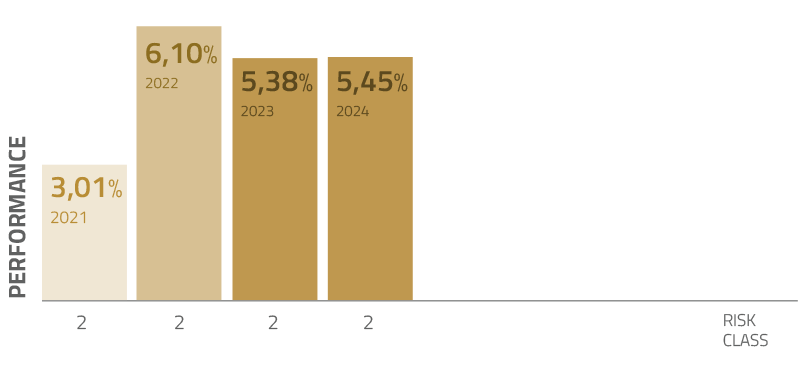

The disclosed yields represent past data, and do not constitute a guarantee of future returns, as the value of the participation units may increase or decrease according to the evolution of the value of the Fund’s assets. The yields disclosed herein are annualised, net of management and depositary fees; they are not net of redemption fees, which should be consulted in the Fund’s instruments of incorporation. The presented yields include the tax payable by the Fund, but do not consider any tax that may be payable by the investees for the income earned. The Prospectus lays out the applicable tax system. The risk level varies between 1 (lower risk) and 7 (higher risk). The indicated risk class is a guideline on this product’s risk level when compared with other products. It shows the likelihood that the Fund will incur financial losses, in the future, due to market fluctuations or our inability to pay your earnings. This indicator assesses the potential losses arising from a future poor performance, and it is very likely that adverse market conditions will have an impact on our ability to pay you. The information on participation units, yields and risk is presented with reference to the period indicated above and as at the valuation date of the participation units.

Redemption Fees Property Core Real Estate Fund:

Up to 364 days (inclusively): 2%

365 to 1094 days (inclusively): 1%

More than 1095 days (inclusively): 0%

Management Company: Square Asset Management - Sociedade Gestora de Organismos de Investimento Coletivo, S.A.

For information on any corrections to the value of the participation units, please see the CMVM website.