SQUARE ASSET MANAGEMENT is specialised in three distinct areas of real estate asset management, with the Income Funds having 1.748 million euros in assets under management (December 31th, 2025). This risk/return management is focused on core assets of sectors such as offices, shopping centres, logistics, retail, distribution, among others.

INCOME FUND CA PATRIMÓNIO CRESCENTE

WINNER MSCI

Unit Holders

December 31th, 2025

TWENTY YEARS OF ACTIVITY

CAPC celebrates its 20th anniversary

The Fund targets investors that are looking for an input in the real estate market supported by professional asset management. Results through consistent income and low volatility have been recognized all through the years both on a national and international level. The Fund was awarded for 14 times in a row with the MSCI prize and 5 times by APFIPP for the Best Accumulation Open-ended Real Estate Investment Fund.

UNIT VALUE 2026-03-12

24,1830 €

-

Fund Type

Open-Ended Real Estate Investment

Fund - Inception Date 15-07-2005

| Fund Name | CA Património Crescente - Fundo de Investimento Imobiliário Aberto |

| Minimum Recommended Investment Period |

3 Years |

| Currency | Euro (€) |

| ISIN | PTSQUBHM0002 |

| Manager | Square Asset Management, Sociedade Gestora de Organismos de Investimento Coletivo, S.A. |

| Distributor | Caixa Central de Crédito Agrícola Mútuo through banking network, branches, and internet banking |

| Custodian | Caixa Central — Caixa Central de Crédito Agrícola Mútuo, C.R.L |

| Minimum Subscription Amount | € 100 |

| Following Subscriptions | No Minimum |

| Subscription Fee | 0% |

| Redemption Fee | Up to 364 days (inclusively): 2% Between 365 and 1094 days: 1%; More than 1095 days: 0% For more information see prospectus |

| Management Fee | 1% per year |

| Custodian Fee | 0,25% per year |

| Performance Fee | 10% of the difference between 12-month Euribor rate plus 2% and the fund performance. |

This information should be supplemented by reading the Fund’s Prospectus and Key Investor Information Document (KIID) which are available on this website, on the CMVM website (www.cmvm.pt), at the placement entities:

CA Património Crescente - (Caixa Central – Caixa Central de Crédito Agrícola Mútuo through their respective branches and internet banking service, and Caixas de Crédito Agrícola Mútuo (as agents of the Caixa Central)) and Depository Bank (Caixa Central — Caixa Central de Crédito Agrícola Mútuo, C.R.L).

Property Core Real Estate Fund - (Best – Banco Eletrónico de Serviço Total, S.A., Novo Banco dos Açores, S.A. and Novo Banco, S.A.) and Depository Bank (Novo Banco S.A.).

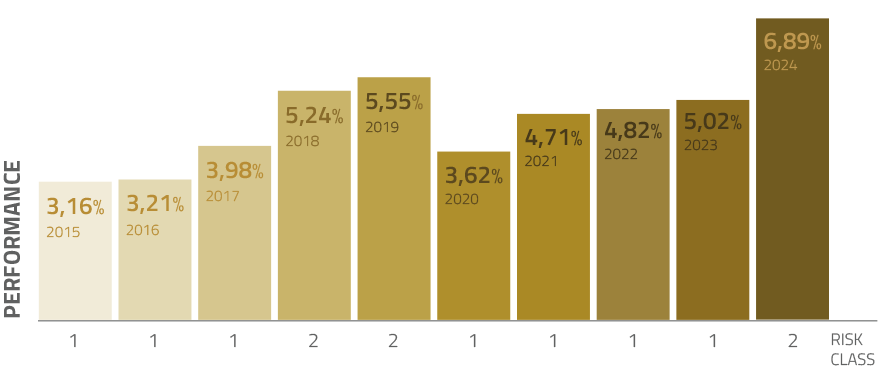

The disclosed yields represent past data, and do not constitute a guarantee of future returns, as the value of the participation units may increase or decrease according to the evolution of the value of the Fund’s assets. The yields disclosed herein are annualised, net of management and depositary fees; they are not net of redemption fees, which should be consulted in the Fund’s instruments of incorporation. The presented yields include the tax payable by the Fund, but do not consider any tax that may be payable by the investees for the income earned. The Prospectus lays out the applicable tax system. The risk level varies between 1 (lower risk) and 7 (higher risk). The indicated risk class is a guideline on this product’s risk level when compared with other products. It shows the likelihood that the Fund will incur financial losses, in the future, due to market fluctuations or our inability to pay your earnings. This indicator assesses the potential losses arising from a future poor performance, and it is very likely that adverse market conditions will have an impact on our ability to pay you. The information on participation units, yields and risk is presented with reference to the period indicated above and as at the valuation date of the participation units.

Redemption Fees CA Património Crescente :

Up to 364 days (inclusively): 2%

365 to 1094 days (inclusively): 1%

More than 1095 days (inclusively): 0%

Management Company: Square Asset Management - Sociedade Gestora de Organismos de Investimento Coletivo, S.A.

For information on any corrections to the value of the participation units, please see the CMVM website.